Many manufacturers are pursuing domestic sourcing for materials and supplies as a way to overcome supply chain disruptions.

How Small Manufacturers Can Develop Risk Management Strategies for their Supply Chains

Page menu

- Introduction

- Responding to Impacts and Preparing For What Comes Next

- Mapping Your Supply Chain Network

- Self Assessment Tool for Supply Chain Risk Management

- Supply Chain Risk Management To-Do List

- Supply Chain Management: A Component of Manufacturer Resilience

- Your Trusted Advisors For Supply Chain Management

- Download this white paper

As a smaller manufacturer, you continue to be more vulnerable to global supply chain disruptions than larger companies. Having to pay more for materials, parts or shipping is a difficult dynamic as you may not be able to absorb short-term losses or even a lower margin. But cost becomes less important if you can’t deliver a product, and as uncertainty has been magnified, it is now essential for you to manage risk by preparing for and adapting to unexpected disruptions in order to increase your resilience and be responsive to customers.

In many ways the disruptions show how small manufacturers are more critical than ever. Many big companies are looking for additional domestic sourcing and do not want to take on additional liabilities and capital investments from bringing more in-house. Those companies also are looking for trusted relationships in their supply chains that will work with them to provide added value from sustainable solutions and even product development.

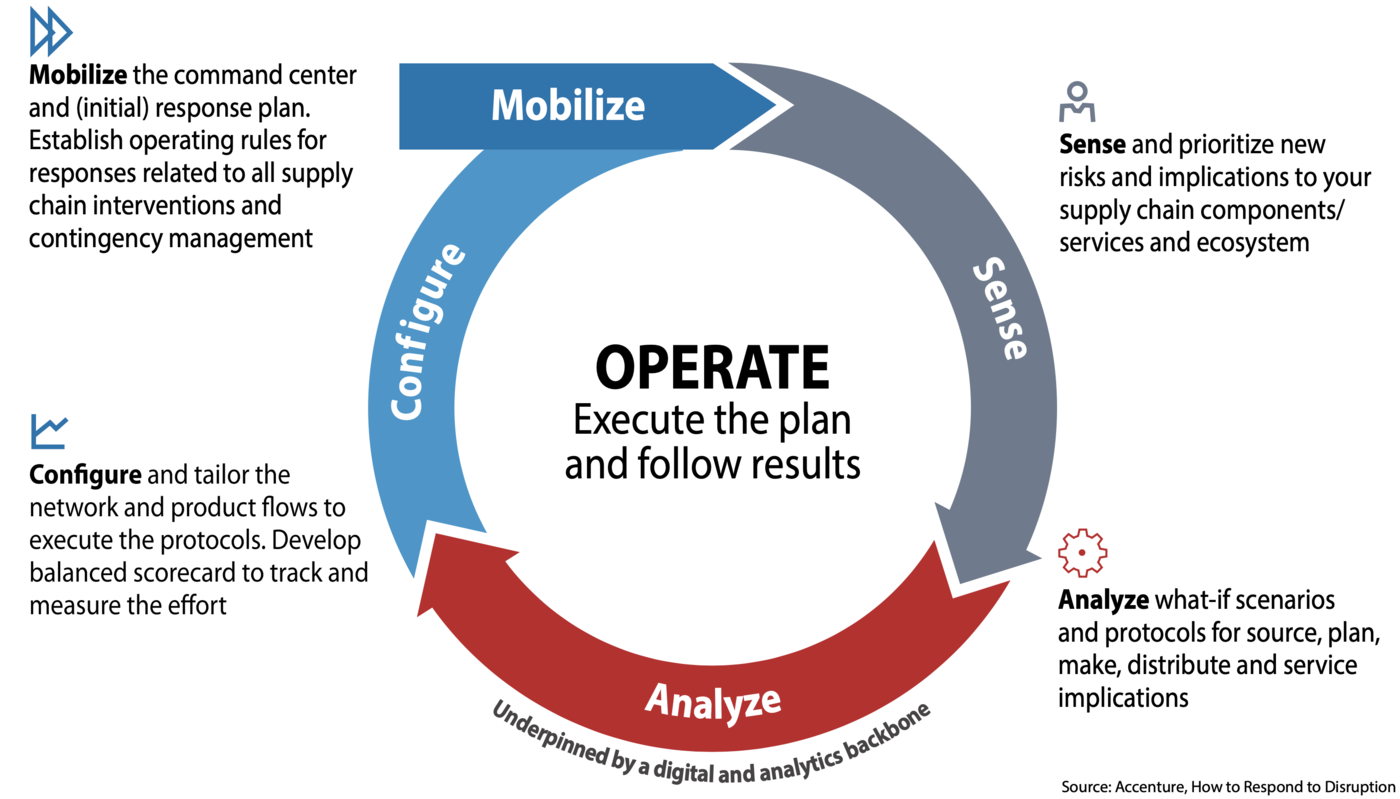

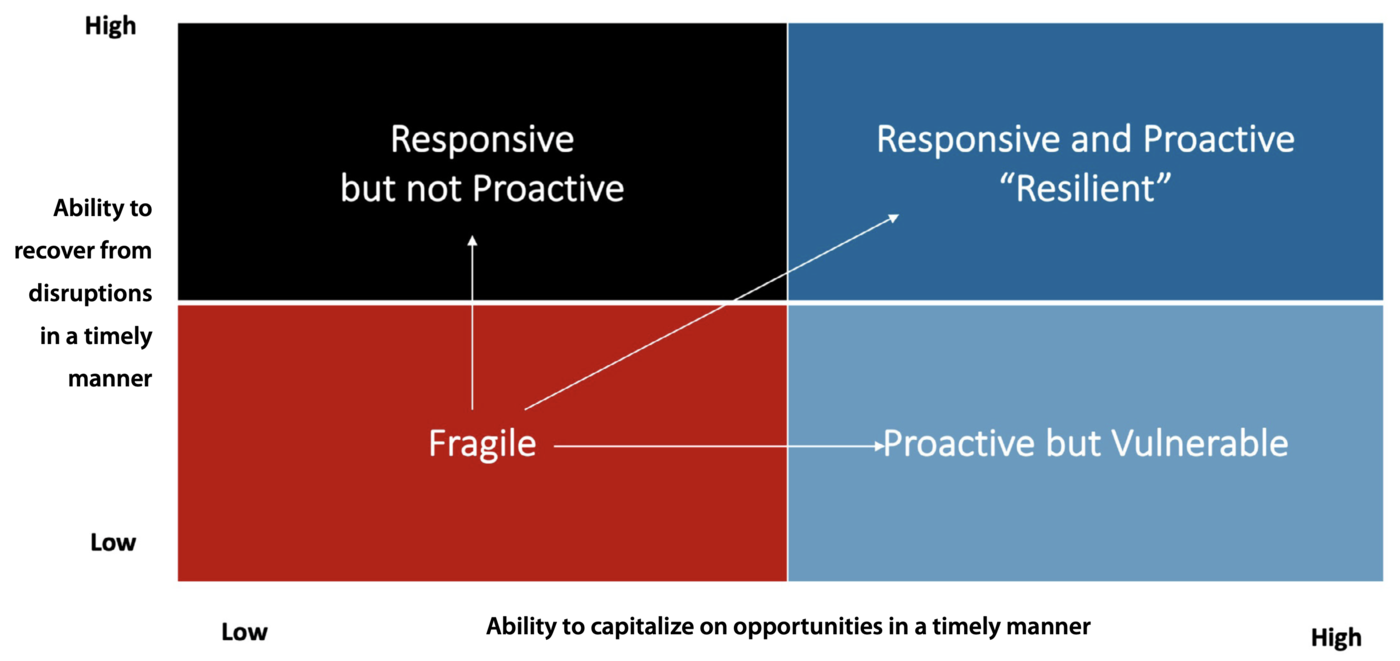

A key aspect of being a trusted supplier and providing sustainable solutions is being resilient. Resilient manufacturers operate with situational awareness of all aspects of their business environment, from their supply chain inputs, to their in-factory processes, to their customer and market outputs. Resilience doesn’t just mean reacting to catastrophic changes to remain in business. Rather, resilience means being proactive about understanding and anticipating all kinds of inevitable change and putting in place the strategies and tactics that allow a company to be both stable and agile at the same time.

Many small manufacturers are now looking at more than just the per unit price. They are now looking at the total cost of ownership (TCO) in their supply chains and asking how they can add value for their customers. Part of the strategic shift is from manufacturers realizing that the costs are considerable for freight, tariffs and time. Looking at the true cost via the TCO approach rather than at just the per unit purchase cost can help you better evaluate sourcing.

Many manufacturers are pursuing domestic sourcing for materials and supplies as a way to overcome supply chain disruptions. There are substantial long-term benefits to reshoring including:

It’s difficult and time-consuming to build and maintain relationships, but growth in domestic sourcing will come from medium and larger manufacturers who invest more in smaller domestic suppliers to solve shortages and other arising issues. It’s an important part of the reshoring mindset.

Manufacturers should seek to improve their overall resilience and move from reactive to proactive with long-term contingency plans, multi-sourcing to build in redundancy, and rating their existing suppliers. The benefits for manufacturers who source from within the U.S. are extensive and include:

- More transparency and control of their supply chains, which can improve quality control, flexibility and time to market, while lowering supply chain risk that often comes from offshore production.

- Producing near the consumer often reduces total costs by shortening supply chains and contributing to a lean and agile strategy, with reduced waste.

- Tapping into a large network of local and regional supply chain stakeholders, from your local MEP Center, to trade, economic development and workforce development organizations and local and regional government agencies that might have timely incentives.

MEP Tips for Manufacturers

How the MEP Can Help: The Importance of Relationship Capital

Relationship capital is the value of a manufacturer’s relationships with its customers, suppliers, vendors and stakeholders in the marketplace. It is difficult and time-consuming for manufacturers to build and maintain relationships, but success in sourcing will come from manufacturers who invest in strengthening supplier relationships. Many manufacturers are now looking for more reliable domestic suppliers to solve their shortages.

Your local MEP Center has experts who can help manufacturers find new sources of supplies, which is not easy for many resource-challenged manufacturers that are occupied with their own operation and deal in relatively narrow networks associated with their specialties. Local MEP Center staff reach out to their expansive networks of manufacturers – locally and nationally, state and regional economic development organizations, and trade groups to raise the manufacturer’s visibility.

Lessons Learned: Don't Fall Into the Low-Cost Trap

Many manufacturers work hard to reduce uncertainties in their operation. They often focus on cost, which is a known quantity. Costs are the reason manufacturers use overseas suppliers to begin with – materials and workforce are typically less expensive in Asia on a per unit cost basis. But “cheaper” is where innovation and value go to die. Competing on cost per unit makes you replaceable. It is not sustainable.

What Supply Chain Disruptions Have Taught Us About Lean Manufacturing

"Just-in-Time" inventory is a popular concept in lean manufacturing which is meant to lower cycle times, reduce waste, and increase productivity. But that concept is not nearly as relevant now as it appeared to be years ago. The reality is that risk has always been a significant factor in supply chains. The current dynamic requires flexibility and risk management. It's not that lean principles don't apply anymore, but the right question to ask may be "what's the healthiest approach for us right now?" Continuous improvement should be the overarching mindset.

MEP Tips for Manufacturers

How MEP Can Help: Supplier Scouting

The fast-changing supply chain dynamics have led to a greater demand

for supplier scouting – which is essentially identifying sources for domestic products and capabilities. The MEP National Network Supplier Scouting program works like this: a manufacturer seeking a new supplier contacts its local MEP Center, which shares the details and technical requirements of the opportunity across the MEP National Network — 51 MEP Centers located in all 50 states and Puerto Rico, with over 1,400 trusted advisors and experts at more than 385 MEP service locations.

Local MEP Center staff, through their own best practices, scout for domestic manufacturers within their state that have the capacity, capability, and interest to meet the immediate need. Results are aggregated from input provided by MEP Centers across the nation and sent to the sponsoring MEP Center so they can start a dialogue with the potential suppliers. MEP Centers facilitate company interactions.

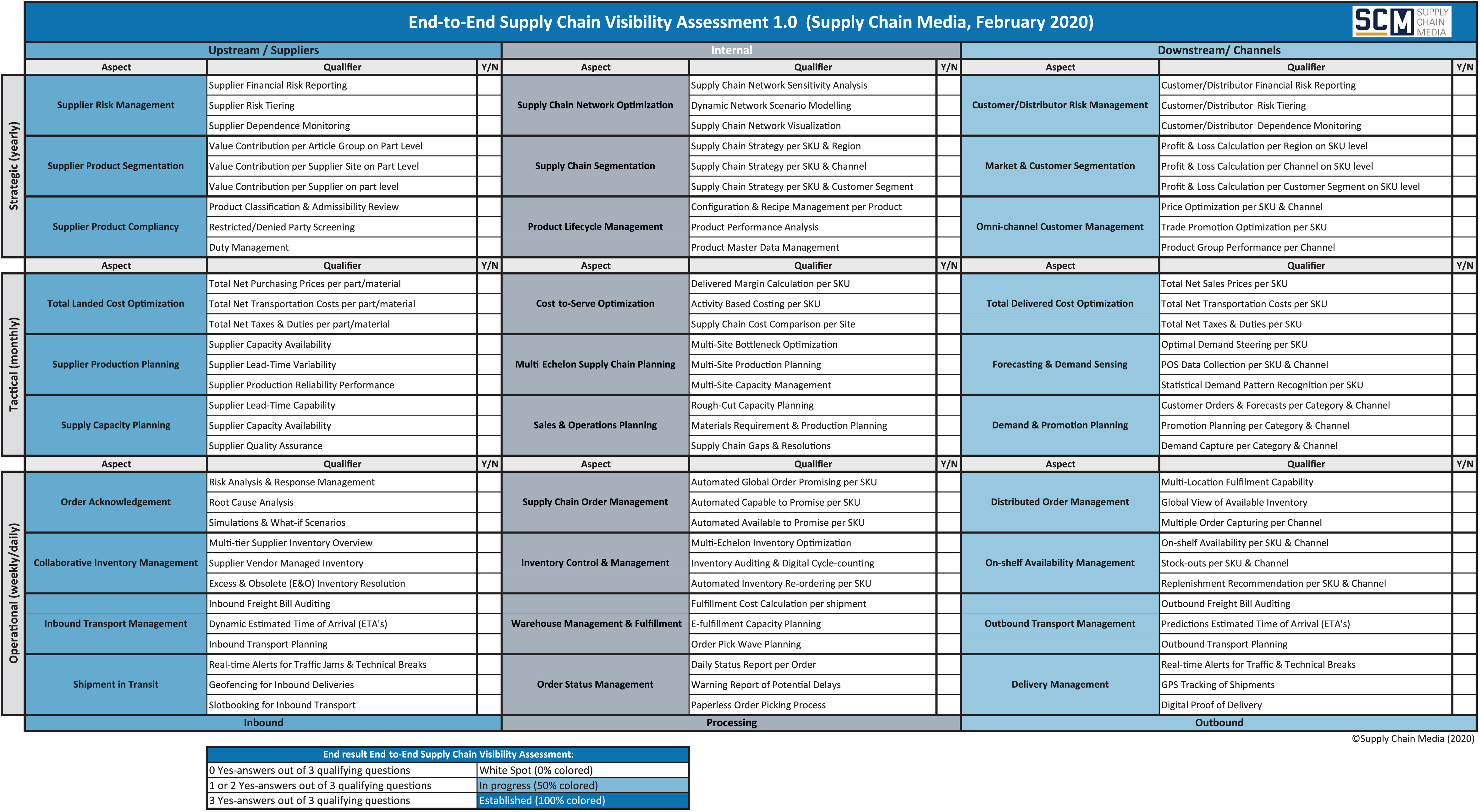

The self assessment tool includes three questions for each aspect of the assessment. A manufacturer can quickly see if it has yet to begin addressing the area, it is a work in progress or it has an established approach or plan. This reveals a snapshot of not only the supply chain but also the value chain development, such as product lifecycle management, market and customer segmentation and distribution management.

There is no question that resource-challenged manufacturers have many choices when it comes to focus and attention for ensuring the growth and sustainability of their business. The self assessment tool is a great starting point to help them prioritize needs.

MEP Tips for Manufacturers

How the MEP Can Help: Build A Balanced KPI Scorecard

Key performance indicators (KPIs) used to be an afterthought for supply chains as securing materials or parts was the emphasis. But one imbalance in a supply chain can make everything else irrelevant. Keep in mind that a balanced scorecard is a mix of quantitative and qualitative data. Your KPIs should measure 2-3 key metrics such as supply chain risk and quality performance. Your KPIs should use industry standards where relevant including responsiveness, on-time delivery (OTD), etc. and should be tailored by vendor. Visibility and clarity in communication is a must both internally and externally. It’s essential to properly weight KPIs in a dynamic nature as they provide insight but are lagging indicators.

Key uses for a supplier scorecard include:

- Measuring performance and driving improvements

- Justifying which suppliers to keep in your supplier base

- Strengthening a negotiating position

- Developing suppliers into better partners

- Rewarding good performers based on objective data

- Gaining consensus on strategic relationships

Your local MEP Center experts can help you with all aspects of supply chain management and show you how to proactively operate with situational awareness of potential backlogs, the economy, and the state of your market.

The Many Approaches To A Risk Management Plan

Small and medium-sized manufacturers often only have a continuity plan if they have experienced a major disaster. For many, the current disruptions have been that disaster, forcing them to shut down a product line or worse. A risk management plan can be as simple as a SWOT analysis (Strengths, Weaknesses, Opportunities, and Threats), provided it takes into account a wide swath of the business, such as people, parts and supplies, IT and cybersecurity, operations, competitors, etc.

Mapping your supply chain and assessing your risks and opportunities will provide you with a mountain of information but not necessarily a roadmap for what to do next to increase your flexibility and readiness. The MIT Sloan Management Review suggests an action list for small manufacturers based on these seven areas:

- Increase capacity

- Focus on low-cost, decentralized capacity for predictable demand

- Build centralized capacity for unpredictable demand

- Increase decentralization as cost of capacity decreases

- Transition to redundant suppliers

- Utilize redundant suppliers for high-volume parts, less redundancy for lower-volume parts

- Centralize redundancy for low-volume products with a few flexible suppliers

- Increase responsiveness

- Prioritize costs over responsiveness for commodity products

- Prioritize responsiveness over cost for short life cycle products

- Increase inventory

- Decentralize inventory of predictable, lower-valued parts

- Centralize inventory of less predictable, high-valued parts

- Increase flexibility

- Prioritize cost over flexibility for predictable, high-volume parts

- Prioritize flexibility for low-volume parts with uneven demand

- Centralize flexibility in a few locations if it is expensive to operate locations

- Aggregate demand

- Increase aggregation as unpredictability grows

- Increase capabilities

- Prefer capability over cost for high-value, high-risk parts

- Prioritize cost over capability for low-volume commodities

- Centralize high capability in flexible sourcing if possible

MEP Tips for Manufacturers

How the MEP Can Help: Linking Supply Chain To Business Strategy

Your local MEP Center has experts who can help you align your supply chain with desired business outcomes:

- Have you aligned your supply chain with business goals?

Manufacturers should integrate their sales, inventory and operations planning (SIOP) programs with their budget and forecasting effort. This is a cycle of forecasting, demand planning and capacity planning. The demand plan begins with a forecast from sales, how it fits into company goals and capacity issues. This impacts material requirements. Knowing what is in the pipeline every month helps decision makers share knowl- edge about risks and what risks may be tolerable. The operations side uses the demand plan to create a supply plan that considers both the capacity and resources available. They may go back to sales and ask to validate the forecast, which is confirmed or adjusted. - Can your suppliers grow with your business?

Does the supplier have the capacity to meet your current needs and would they be able to accommodate an increase in your business? Is the supplier financially stable? Some external indicators of financial risk include losing customers, lawsuits, or the loss of key personnel. You should also consider if a supplier is a good fit for your company. If you place smaller orders, would your supplier prioritize other orders ahead of yours – possibly leading to production delays? - Can your suppliers innovate alongside you to meet new designs?

Finding suppliers who understand their role in the product life cycle is critical to supply chain integration and strategy. Meeting production standards at the right price doesn’t necessarily equal long-term value. The competitive advantage in the supply chain is the ability to respond to changing customer demands.

Manufacturing Resilience Grid

Stay in Touch

Sign up for our newsletter to stay up to date with the latest research, trends, and news for How Small Manufacturers Can Develop Risk Management Strategies for their Supply Chains .